Forex Contract Size

Contents:

For charts on your workspace, simply click the market name and choose the point value you would like to trade. IG International Limited is licenced to conduct investment business and digital asset business by the Bermuda Monetary Authority. Have your questions answered by like-minded traders and IG staff over at IG Community. Place your mouse on the symbol within the MT4 market watch window→Right-click→Specification to see the rollover rates for related commodities. The trading hours above are in accordance with Platform time. Clients may speculate on price movements in the value of stock by trading our CFDs on stock indices.

It is https://forexaggregator.com/d at $50 times the value of the S&P 500 while the standard contract was priced at $250 times the value of the index. Keep in mind that the Chicago Mercantile Exchange delisted the standard-sized contract in September 2021. Its value depends on an underlying benchmark, asset, or a group of assets, They are set between two parties who use them to trade different securities and access various markets. Contract values are based on price fluctuations of the underlying security. Derivatives can be used to hedge a particular position or speculate on price movements.

How do I change contract size (point value)?

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. The daily swap rates shown in the platform are charged seven times per week.

Contract sizes are often standardized by exchanges and vary depending on the commodity or instrument. They also determine the dollar value of a unit move or a tick size in the underlying commodity or instrument. Almost all currency futures — except some e-micro futures and some lesser volume contracts — use the USD as the quote currency, which are called American quotations.

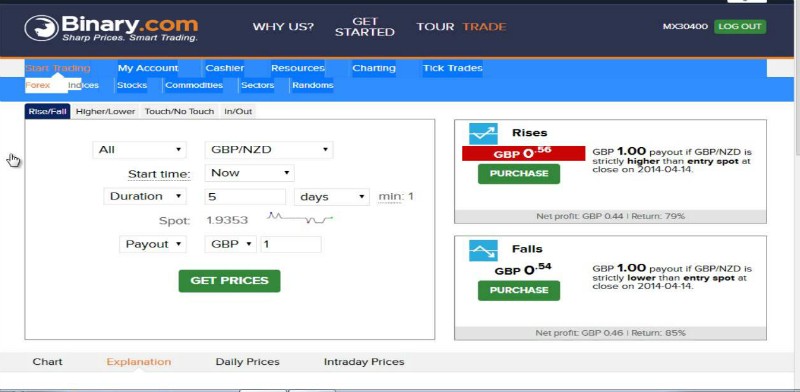

Physical stocks with zero commission!

If they are long a https://trading-market.org/ then they will need to pay the financing, if they are short they receive it. All spot forex brokers provide this facility automatically and the levels are similar to the leverage traders can obtain with CFDs or spread bets. Spot forex traders were the original margin traders and their brokerage will require them to place margin on account to fund their activities. A standard spot forex contract is called a lot – the contract size set at 100,000 of the base currency. So, when traders buy or sell 1 lot of EUR/USD they are buying or selling €100,000. Some retail brokerages offer smaller sizes, like micro-lots which is for 1,000 of the base currency or mini-lots which is for 10,000 of the base currency.

This information will be available directly from your trading platform. It’s crucial to know the size of the contract you are trading as this will help you know exactly how much exposure you have. This is also significant when thinking about risk management, as you’ll need to know how much you might potentially lose based on the amount you are trading. Trading in Futures or Options involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment .

How to calculate lot size in forex?

The types of https://forexarena.net/places that you can invest in include the FX market, the stock exchange and commodities market, among others. There’s no limit to the number of markets you can trade, meaning that you have the opportunity to trade hundreds of assets. See our minimum spreads, pip values, swap fees and other conditions.

This can also stand for a ‘percentage in point’ and ‘price interest point’. It’s a standardized unit used to show the change in value between a currency pair. A ‘ticker’ is a symbol used to identify a particular company or asset on a publicly traded market. Tickers are usually simple abbreviations and pretty easy to distinguish. A good example is the GBPUSD, which refers to the Great British Pound – US Dollar currency pair. You’ll soon get familiar with tickers and learn to identify the assets you’re watching in the blink of an eye.

We will now recalculate some examples to see how it affects the pip value. To take advantage of this minute change in value, you need to trade large amounts of a particular currency in order to see any significant profit or loss. Forex is commonly traded in specific amounts called lots, orbasically the number of currency units you will buy or sell. Thus, 0.1 lot is equal to 1 mini lot, and 0.01 lot is equal to one micro lot.

Stock market rallies: what are they and what causes them? – FOREX.com

Stock market rallies: what are they and what causes them?.

Posted: Tue, 05 Jul 2022 07:00:00 GMT [source]

Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Join the ZFX Academy mailing list to be the first to know about our next webinar, article or guide. Contracts of FX futures are different from the Spot forex mentioned above. As a result of the constant stream of small investors, forex has gained popularity from 2008 to 2009. With the rapid development of global technology, investment has become more familiar. The terms Forex, Forex Currency Pairs, and Spot Currency or FX as mentioned on the Company’s website, refer to CFDs on Spot Foreign Exchange.

The difference in FX futures specifications

To prevent the account from being stopped out, traders are advised to top up their account or to close out some positions to reduce margin used, and to avoid the possibility of being stopped out. The “Margin Call Percentage” varies on the account type and agreement with Fullerton Markets. Please speak to our customer service officers for more details. Since FXCM micronizes its CFD contracts, it is necessary to use a multiplier in the Notional Value equation. This is because FXCM’s contracts, are a fraction of a full futures contract and have either different prices per point or different prices per pip than the futures contract.

No matter your experience level, download our free trading guides and develop your skills. Deepen your knowledge of technical analysis indicators and hone your skills as a trader. Fullerton Markets employs “Straight Through Processing” , passing on customers’ trades directly to our tier-one liquidity providers. Fullerton Markets offers the best liquidity with lowest latency connection to our extensive tier-one liquidity partners. All trades at Fullerton Markets are executed directly with the market without requotes.

For Platinum and High Grade Copper a 3-Day swaps are applied at market closed on Friday. Join thousands of traders who choose a mobile-first broker for trading the markets. Most Forex contracts are deliverable on T+2 (Trading day +2), to accommodate for Saturday and Sunday. The bank charges 3 times the normal swap rate on Wednesdays. Please note that there is no margin requirement for a fully hedged trading account. However, clients should manage their account with respect to market volatility and swap charges.

What are soft commodities and how do you trade them? – IG

What are soft commodities and how do you trade them?.

Posted: Fri, 02 Sep 2022 15:53:44 GMT [source]

X GLOBAL Markets Ltd and XGLOBAL FX Ltd are regulated investment firms that are both 100% owned by X GLOBAL Holding Ltd. Look up the meaning of hundreds of trading terms in our comprehensive glossary.

- We do not apply any weighting or biases to our pricing sources.

- The daily swap rates shown in the platform are charged seven times per week.

- Point Value – a measure of one basis point change in the futures price.

- This lot size is multiplied by the last traded price to get the options contract value of USD-INR.

- Margin call happens when the total Equity is less than the “Margin Call Percentage” of the total margin used.

A standard lot of EUR/USD refers to a 100,000 EUR contract, and a mini lot of GBP/USD refers to a 10,000 GBP contract. When talking about one lot of a contract, the lot size refers to the standard lot. Positions can be held without paying or receiving a swap fee for the first 7 calendar days. After that a storage fee will be charged each calendar night thereafter at a rate of 10 USD per 1.00 lot. To clarify how this is counted, the platform will not charge a storage fee for the first 7 midnights that pass after a position is opened.